This article published by The Conference Board is by Paul Washington and Merel Spierings. Here is an excerpt:

This article published by The Conference Board is by Paul Washington and Merel Spierings. Here is an excerpt:

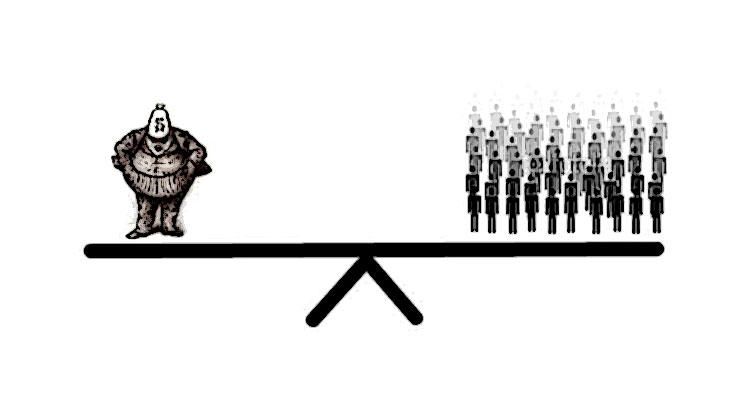

In this era of intense political polarization in the United States, and with the immediacy, ubiquity, and (often) inaccuracy of social media, companies are subject to ever-greater scrutiny for their political activities. The combination of polarization and scrutiny is enough to make some companies choose to limit, or avoid engaging in, political activity, including spending.2 Others have focused on get-out-the-vote efforts that are presented as nonpartisan, good citizenship efforts that can find support across the political spectrum.3 But banning, or severely limiting, a company’s political activities to just those focused on areas like voter registration isn’t a realistic option for many firms.

In the wake of the 2020 US election, The Conference Board ESG Center held a roundtable to discuss the current regulatory environment for corporate political activity, the prospects for shareholder proposals on the topic, and best practices in addressing this era of scrutiny and polarization. Following the events of January 6, the ESG Center also conducted a survey of 84 large public and private firms on how companies and their employee-funded PACs are responding to the Capitol riot and objections to the election certification. The discussion and survey generated the following insights for what’s ahead on corporate political activity:

Continue reading here for these insights and the rest of the story.

Leave a Reply