Financially strapped Greece, whose economic crisis has become a subject of global concern over the past four years, is at a crucial point in its negotiations with creditors and European representatives. Demand for economic reforms to address national the Greek budget deficit is coming face to face with concern that its national economy is struggling too much to implement major changes in a proper time. At stake in this grand debate is the European project itself.

As the scale of the Greek crisis became clear during 2009, leaders across Europe were forced to take an interest. The prospect of Greece leaving the Eurozone (the much feared Grexit) has spooked investors across the world ever since, causing wild swings amounting to a drop in value of the Euro compared to the dollar and other international currencies. “All of us in Europe probably agree that a Grexit would be a catastrophe, for the Greek economy; but also for the Eurozone as a whole”, said Pierre Moscovici, who is the head of the European Economic and Financial Affairs to the German newspaper Der Spiegel in an interview on Friday, March 13th.

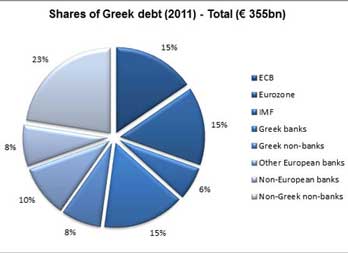

Many European governments have warned that a majority of the budget and economic crisis was caused by the Greek government living beyond what it could afford while allowing widespread tax evasion. When the crisis was sparked during the world economic crisis of 2009, Greek public debt stood at $407 billion Euro, an astonishing sum for the size of the economy. According to the latest statistics available, the Greek government spent 107.5 billion euros from 2004 to 2014 while bringing in only 87.9 billion euros in revenue, leaving a budget shortfall of 19.6 billion.

But, “if one country leaves this monetary union, then markets will immediately ask which is next, and that could be the beginning of the end”, Mr. Moscovici explained in his interview.

Similar deficit concerns have also plagued European economies like Italy, Spain and Portugal, also rocked by economic instability for over five years. Each time decisions related to the Greek debt crisis have surfaced, a wave of economic indicators swing across these nations.

To further inflame fears, the recently elected Syriza Party, led by the new Greek President Alexis Tsipras, has publicly suggested that dropping the euro currency and breaking its promise to repay its debt is possible without more support from the nation’s creditors. The elections which took place in December revealed a deep public scepticism that the austerity demanded by creditors was harming the nation. With this left wing message, the Syriza Party secured unprecedented support.

“Red lines in negotiations cannot be crossed, that’s why they are red, if the Germans choose to push the issue to a rift, they will bring catastrophic consequences on themselves”, Greece Environmental Minister Panagiotis Lafazanis said to the news agency Real News in an interview. The negative tone of the original negotiations has moderated somewhat recently. However, in a sign of the deep cultural significance of Germany’s unusual role in the debt discussions, Greece recently has asked Germany to pay reparations for its World War II-era occupation of Greece.

It will be up to the two sides to come up with an agreement that will be both beneficial for the struggling Greek people and Europe. Creating a workable system for the country to repay its debt in a responsible manner can save the country. Failing to do so will have enormous consequences. “It should be really important that our work is marked by trust,” Germany’s powerful Chancellor Angela Merkel said about Greece’s debt repayment. Ultimately, the same is true for the success of the European project itself.

Leave a Reply