Jon Ogden is the founder of TooBigHasFailed.org, a website dedicated to educating the public about the corrupt practices of the big Wall Street banks. He advocates for breaking up the largest banks and for a consumer revolt against banking with them.

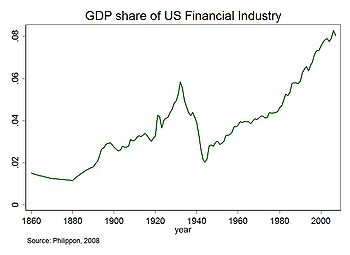

TooBigHasFailed.org makes the case that we’ve broken up the big banks after the Great Depression, and that we must do it again in the 21st Century in order restore faith in our financial institutions. The prime focus is on the six “megabanks” of Wall Street, all of which operate in more than fifty countries and hold considerable influence on policy-makers and the global economy.

From About Us section:

“Too big has failed. We don’t want it to fail again. We want to see a smaller, simpler, and safer Wall Street—one that isn’t so powerful politically and one that doesn’t put the entire economy at risk. We’re hoping to join with established networks to further a sustained, focused, grass-roots effort in reforming the status quo on Wall Street. We want a vibrant global economy, one that is robust instead of fragile.”

INTERVIEW WITH JON OGDEN

Craig Boehman: What motivated you to start Too Big Has Failed?

Jon Ogden: After I watched the documentary Inside Job, I saw a financial crisis reading list on Google+ and became interested in reading everything on the list. When I finished the list – which had about 20 books on it – I decided that I needed to add my voice to those who are speaking out against Wall Street corruption. I could see that if things don’t change very soon, then we’re bound to experience another global meltdown. Being part of the solution to that problem motivates me.

CB: Are there others working with you?

JO: I have a few friends and family members who’ve been very helpful in offering feedback, but it’s mainly just me.

CB: On average, how much time do you put in weekly?

JO: Right now I put over 50 hours a week into it, which is obviously unsustainable. I’m writing an e-book to try to summarize what I learned from my research, and I’m relying mostly on prior savings to get by financially. When the e-book is released, hopefully very soon, I will get a full-time job again and maintain the social media accounts on the side.

CB: Social media has undoubtedly played a huge role in grassroots organizing and the dissemination of information in a variety of campaigns. Do you see this trend continuing?

JO: Yes, it will continue. I think the great test of the millennial generation (which I’m part of) is whether we will use the Internet to organize and fundamentally reform the broken system that we’ve been handed, or whether we will use the Internet to distracted ourselves from these problems. It’s not clear yet to me how we’re doing on this front. Obviously, there’s a lot of distraction and chatter out there, but there are also tremendously useful groups, like your Occupy Wall Street Facebook page, that keep people focused on the problems at hand. What we need is to figure out better ways to organize online and demand genuine political reform in Washington. The Internet can be a useful means to that end, and I hope that TooBigHasFailed.org is playing a role in that regard.

CB: Many critics of Wall Street have pointed out that many of the schemes that investment bankers and the industry at large employ are too complicated to adequately communicate, at least not sufficiently enough to cause an uproar that would bring a lot more people into the streets to protest and to bring about real change. Do you think activists are doing their jobs correctly, or are we stuck in neutral getting our points across?

JO: We are sort of stuck in neutral. Wall Street reform is being dismantled at a rapid pace each day in Washington, and there aren’t enough voices opposing Wall Street’s lobbying efforts. In a sense, that’s understandable. The public is busy. They’ve got to earn a living. They don’t have resources to devote to fighting Wall Street. The problem is, if we don’t figure out a way to get out of neutral, Wall Street will continue to abuse us as they’ve been doing for the last few decades.

We activists need to figure out a better strategy to re-focus our efforts on Wall Street reform. I’m not sure I have the answer for how to do that, though I desperately wish I did. We need an innovative approach that really catches people off guard. Something like uniting to troll a specific Congressman who flagrantly promotes Wall Street corruption, or uniting to highlight the corruption in just one bank for a month – Bank of America would be a good candidate. I’m not sure what the process should be; I just know that we need a strategy to kick things out of neutral. Something to get us in the news again.

JO: It’s certainly a main goal of ours, yes. However, I lost a bit of faith in the efficacy of such a strategy when I learned that in 2012 the bank that was getting the most customers switching to it was Bank of America. What a crock that is, right? But it’s true. Most people only seem to care that their bank is slightly more convenient or that they have a good mobile app. They don’t think about the larger implications of their actions, which is unfortunate because we all suffer as a result of that line of thinking. So, yes, we’d like to see more people switch to local lenders, but we recognize that large-scale change is probably going to have to come from Washington if it’s going to come from anywhere.

CB: Off the top of my head, I would guess that moving your money to another bank is probably the most effectively legal way to protest in this country, because as consumers, we really vote with our money. It appears that Wall Street also votes with their money, which is really quite more substantial than individual efforts have shown – at least so far. How would a change in paradigm affect our banking culture if a majority of the people switched banks?

JO: I think that if more people said that they weren’t going to bank with the Wall Street banks, then Wall Street would be forced to rethink what it’s doing and become simpler and safer. Again, I think that approach is probably a little ideal simply because, again, it’s hard for people to see the personal benefits of switching to a local lender. However, one simple thing people can do that would dramatically reduce the amount of money Wall Street takes from us and simultaneously reap tremendous benefits for those who did it is that if they have a retirement account (whether personal or through their employer) to make sure it’s invested in index funds rather than actively managed funds.

The concept is too complex to fully explain here, but I think getting more people to learn about index funds would be a major milestone in hurting Wall Street. This is increasingly a major focus of my efforts because I think once people understand the difference between index funds and actively managed funds, they’ll be very likely to switch to index funds. The monetary benefits to those who switch are obvious once people understand the concept, and people are motivated by that, for good reason.

CB: How do credit unions work compared to a big bank like Wells Fargo or Bank of America?

JO: Credit unions are orders of magnitude smaller than the Wall Street banks, like over 2000-plus times smaller. Credit unions are also member-owned rather than shareholder owned, which means that each customer is a member and has more of a say of what goes on at the institution. What’s more, credit unions (with very rare exception) aren’t engaged in most of the risky derivatives activity like the Wall Street banks are.

CB: How would communities benefit if a majority its people had their accounts and loans with credit unions?

JO: Well, small business lending would increase since local lenders are far more likely than the Wall Street banks are to lend money to start-ups. And all the money that goes for workers at the institutions headquarters (marketing, management, etc.) would go to the community rather than New York where Wall Street is headquartered. Plus, local lenders are far more likely to have a personal stake in the local community.

CB: Elizabeth Warren has pushed for Wall Street reform, including a new version of the Glass-Steagall Act which was repealed under the Clinton Administration. How significant was Glass-Steagall?

JO: It’s difficult to pinpoint precisely how significant Glass-Steagall was. Lots of other countries, like Canada, for instance, don’t separate investment banking from commercial banking – which is the heart of Glass-Steagall – and those other countries have relatively safer banking systems. But that doesn’t mean Glass-Steagall wasn’t significant. It did keep the banks much smaller, for example, and that was tremendously helpful. It also made the system simpler because a commercial bank could focus solely on commercial activity while an investment bank could focus solely on investment activity. Overall, I think Glass-Steagall should be restored, but I think people shouldn’t assume that it will be a panacea to our problems. Elizabeth Warren recognizes this fact and frankly admits it, so I think she’s very astute in her approach. She knows what she’s doing.

CB: Do you think new Glass-Steagall legislation would be effective given the many allegiances to Wall Street interests in the Democratic and Republican parties?

JO: Yes, it would be effective. One thing about Glass-Steagall that I didn’t mention in the last comment is that it split up the lobbying efforts of commercial banks and investment banks, so the lobbying efforts weren’t so concentrated. That’s one of the biggest reasons why I support restoring the law. Anything to break up Wall Street’s power in Washington is a good move, in my opinion, since the reason we’ve had such a hard time reforming Wall Street is because they’ve captured Washington. We have to break that stronghold.

Visit TooBigHasFailed.org

Leave a Reply