The Social Security and Medicare programs, which are currently stable and intact, will inexorably have to endure a fiscal challenge in the near future – a challenge caused by the retirement of the largest generation yet. It is an undeniable fact that a conflict will come because of the retirement of the 76 million Americans born during the “baby boom” years from 1946 to 1964. However, with strong, progressive political action, this fiscal challenge can be greatly assuaged and made practically innocuous to both the existence and purpose of these programs.

Due to the fact that taxes could easily increase and thus fund the Social Security and Medicare programs, benefits should not be cut. It is vital that the benefits beneficiaries receive stay high, since these elders typically need the “additional” income at that point in their lives more so than when they were young. If benefits are cut, the retirees may not be able to support themselves financially and may not have access to the proper health care they deserve.

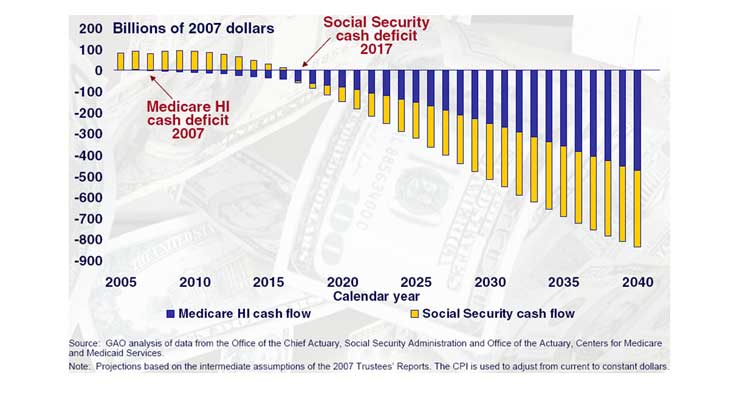

In essence, the root of this conflict stems from the fact that the amount of taxes received will be lower than the cost of Social Security and Medicare, because the population of people over 65 is projected to grow faster than the current working-age population. Along with the issue of an unbalanced increase in retirees, the life expectancy of Americans in general is expected to grow in the coming decades. As the surplus of money available for Social Security and Medicare decreases until it is eventually fully exhausted, Americans all over the nation debate the future of these programs in regard to how the end of a surplus will impact both current beneficiaries and those who plan to receive the benefits later on in their lives. A decision to increase taxes, and thus keep benefits high, can potentially save the fate of Social Security and Medicare, as increased taxes will stymie the idea of privatizing the system.

Logically, increasing taxes solves the issue concerning a lack of tax money to fund the Social Security and Medicare programs. Currently, the tax rate for Social Security is 6.2%. Meanwhile, the tax rate for Medicare is at 1.45%, although an Additional Medicare Tax at a rate of 0.9% exists if the individual’s wages, compensation or self-employment income exceed a certain threshold amount dependent on the individual’s filing status. In essence, the tax rate for both programs combined is considered to be either 7.65% or 8.55%, depending on the income and circumstances. Even at this rate, the amount of money needed to fund Social Security and Medicare will be substantially greater than the amount of money received in the not-too-distant future.

One way to preserve the system, and maintain the treatment of beneficiaries in regards to benefits, is by increasing the tax rate required for the working-age population by at least one percentage point. In fact, the last time a change was made on the rate for Social Security was in 1990, nearly two decades ago. It is only reasonable and natural for both taxes to increase with time.

The Additional Medicare Tax for high-income earners was applied after the start of 2013. This means that this tax is relatively new, and thus, hints at the general direction the federal government should take in order to receive more funding. The Additional Medicare Tax reflects an idea of taxing high-income earners at a higher rate than others, which can be very useful in receiving more funds if applied to the Social Security tax. Those who are more fortunate should simply contribute more, if not at a higher rate.

Not only is this not applied for Social Security tax, but there is also a limit on the level of wages, which are subject to pay the Social Security tax. Currently, this limit is at $113,700. If this limit is raised to at least $200,000, the government will be able to receive more money from individuals who are able to contribute more financially. It does not make sense to limit taxing the wealthy, especially when they are capable of supporting the system that essentially will support them in the future. At $200,000, the taxable wage limit simply becomes more aligned with the increasing income of high earners. In essence, increasing the tax rate of Social Security and the limit on the level of wages subject to the tax will allow the true intents of Social Security and Medicare to persevere.

Health insurance should be guaranteed for all those who had paid and been actively involved in the system. Slicing those benefits can be potentially dangerous, as these people are generally more vulnerable to disease and health problems. While changing the system to have beneficiaries with higher income receive lower benefits than poor beneficiaries may ease the fiscal challenge, it is not fair for those who have worked their entire lives, as they are provided with less than what had been promised.

The point of the system is to put in money for the current retirees, so that the future working-age generation could put in money for the older generation. Social Security and Medicare are not meant to be programs where the amount of money “put in” is increased. They only serve as supplements to other retirement and investment plans, which high-income earners mostly participate in higher rates than the general population. It is simply unfair to not provide the “supplement” high-income earners deserve simply because they are financially well off, as the whole point of the system is to make retirement easier.

Privatizing Social Security and Medicare

It makes more sense overall to take the money from people who are still working and young, not those who at any second may need to take full advantage of the Social Security and Medicare programs which they had spent their entire lives supporting. For this reason, benefits should not be cut for the poor or the wealthy.

In terms of the perseverance of these programs, some Americans foolishly advocate replacing Social Security and Medicare with a system that is privatized. A privatized system, however, is not advantageous because of the many unforeseen factors that go into altering the system. Privatizing Social Security and Medicare means having each American pay for oneself, instead of paying for the current retired generation. The conflict with this approach is the fact that current retirees and people about to retire will not have had a chance to invest, meaning they would be left penniless. The switch, thus, is very difficult to make.

In terms of the perseverance of these programs, some Americans foolishly advocate replacing Social Security and Medicare with a system that is privatized. A privatized system, however, is not advantageous because of the many unforeseen factors that go into altering the system. Privatizing Social Security and Medicare means having each American pay for oneself, instead of paying for the current retired generation. The conflict with this approach is the fact that current retirees and people about to retire will not have had a chance to invest, meaning they would be left penniless. The switch, thus, is very difficult to make.

Also, a privatized system allows people to receive higher benefits, but at a price; risk is much more involved with the privatization of these programs than with the current programs in place. Similar to stocks, investments may increase or decrease, depending on the circumstances of the situation. For retirees, this is extremely dangerous, especially if one is fully dependent on the money that was put in. Widows and survivors are also left in an eccentric position in a privatized setting, as opposed to the guidelines and instructions governmental programs have intact for these groups of people.

The strongest reason why privatization of Social Security and Medicare should not occur has to do with the original intent of these programs. Never were these benefits distributed supposed to be viewed as investments. Instead, they were to be viewed as supplement plans that served as a backup in addition to existing “private” plans.

As the United States progresses into a position where a surplus for Social Security and Medicare is absent, decisions must be made. These decisions will influence both the current and future beneficiaries, and thus, need to be made with great thought. It is only logical for taxes to increase, since cutting benefits in this case could be lethal. By increasing taxes, people at an age where they are in dire need of money and who had worked their entire lives, rich or poor, are able to obtain what they had put into the system. Furthermore, this proposed increase prevents the privatization of these programs, which can be difficult to switch to and potentially dangerous. An increase in taxes, whether by making the wealthy pay more or by having the general public pay at a higher rate, could easily save the future of Social Security and Medicare.

Leave a Reply