I needed a moment to wrap my head around (Not very Presidential) Trump’s GOP approved Tax Bill. First, I had to get over the way GOP Senate members scrambled, like roaches in the dark to pass their version of the bill. I thought that this must be how Americans felt when a small group of Senators met around this time in 1913, to pass the Federal Reserve Act.

Next, was the way GOP Members touted this Bill as ‘Tax Relief for The Middle Class’ in general, but it specifically brings Permanent Tax Relief to Corporations. President Obama tried to reduce the Corporate Tax Rate down to 28%, but could not get approval. Trump, has somehow gotten approval for 21%. In true Trump fashion, GOP Members of Congress gathered with the ‘Dictator In Chief’ on the White House’s South Lawn, to take a victory lap & ‘Kiss the Ring’. However, Everyone is mum about the $500B- $1.5T this Bill will cost over 10 years.

Speaker Paul Ryan is slow to tell us how We will pay for this Bill, but is quick to explain why it is necessary for Corporations to have a Permanent Tax Cut. Republicans in general cite ‘Corporate Forecasting’ as the main reason- explaining how Corporate Entities need 10 Years advanced notice to speculate Future Earnings.

My question to GOP Congress Members is: What about American Citizens? Why are Corporations given preferential treatment over People? The notion of “Trickle Down Economics” is laughable, especially when several Corporate CEOs admitted They would spend the recouped funds on Corporate Buybacks & Executive Salaries. Even Bill supporters, like Sen. Marco Rubio doubt Corporate seeding will reap meaningful gains for employees.

Recent Employee Bonuses offered as a Corporate ‘Show of Good Faith’, have already fallen flat. When you consider that a (Corporate) Employee Bonus Package carries a tax deduction; If you’re like me, you may ask:

- Why are these Companies (really) rewarding Employees now?

- Many of these Corporations have held surpluses for years. Knowing how this will spur Economic Growth, why did They wait until This Year to give back?

- Did Corporate America purposely stifle Economic Growth during the Obama Administration?

Donnie “2 Scoops” is quick to take credit for the success of the economy, but The Truth is, The Obama Administration’s Final Budget Year ended in Oct. 2017. The Trump Administration doesn’t have a Budget yet. How can he take credit for results, when He doesn’t have a System in place?

I guess he took a cue from Rudy Guiliani, when he took credit for his predecessor, Mayor David Dinkins’ “Safe Streets, Safe City” Program. This Program started a trend of lower Crime Rates in New York City, that continue to this Day. It appears that Trump wants to “Make America Great Again” the Old Fashioned Way – by taking credit for Black Ingenuity. Anyway, I digress…

My argument for Republican Members of Congress is: If it makes sense to grant Corporations 10 Years to forecast earnings, why not offer American Citizens the same leeway? I’m sure that there are families in every State that would benefit from having the ability to plan ahead for Children, Mortgage payments, College tuitions, Retirement, & ElderCare.

Why are Corporate Rates permanent? Why didn’t Republicans at the very least, present a 10 Year Plan that gives both Taxpayers & Corporations time to forecast their respective budgets? We have been fed a lot of rhetoric over the years, about why Corporate Entities should be considered Individuals. That is a two way street.

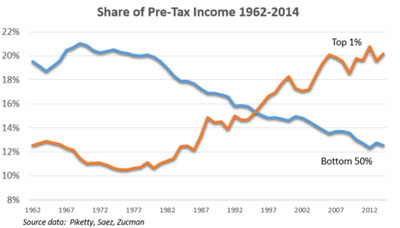

Corporate ‘Individuality’ has led to a flip flop in the distribution of Taxes over the decades. The American Citizen is being robbed of Their Assets & Resources, while Executive Salaries & Dividends rise. This new Tax Bill amplifies Corporate America (a Multinational Body)’s looting of the Rights, Privileges, & Dreams of Everyday People.

The short-term gains that ‘Average Americans’ receive on the front end of the Bill, are overshadowed by the losses expected on the back end; by way of (gradual) limitations on State, Property, & Individual deductions. Elimination of ACA’s Individual Mandate will most likely lead to fewer enrollments & increased premiums.

I know we’re already in a 2018 State Of Mind, but I can’t help but feel that This is what 1928 felt like.

Leave a Reply