US-EU trading pact agreement would be major boost to stability of democratic world if done right

Democracy, elections and voting at Democracy Chronicles

The US and the Entire EU Would Significantly Benefit from a Transatlantic Free Trade Agreement

The US and all EU member countries would significantly benefit from a comprehensive transatlantic trade and investment partnership (TTIP). If it is possible to largely eliminate not only tariffs but also non-tariff trade barriers, real gross domestic product per capita would significantly increase, and new jobs could be created.

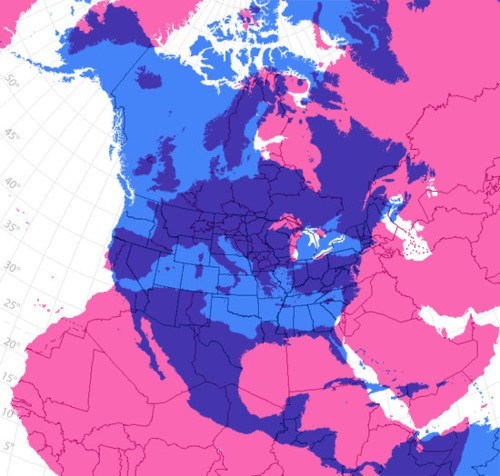

However, the social welfare gains in this largest free trade zone, with over 800 million inhabitants, would stand in contrast with real income and employment losses in the rest of the world. These are the results of a current ifo Institute study commissioned by the Bertelsmann Foundation and released one day before the visit of US President Barack Obama in Berlin.

The study shows how long-term real per capita income would change for a total of 126 countries as a consequence of a transatlantic free trade agreement. According to the calculations, the US would achieve the greatest growth.

There, the long-term gross domestic product per capita would grow by 13.4 percent. Social welfare gains would also be achieved in the entire EU region. In all 27 member countries, real income per capita would end up almost five percent higher on average. Great Britain would show the largest increase in income, with a real increase in income of almost 10 percent per capita.

EU member countries that would profit more than average from a far-reaching liberalization of trade include small export-oriented economies such as the Baltic States and also the crisis-ridden southern European countries, for whom imports from the US would become cheaper. In comparison to the rest of Europe, the large economies of Germany (4.7 percent) and France (2.6 percent) would benefit less than average from a comprehensive free trade agreement.

However, the intensification of trade relationships between the US and EU would result in these economies importing fewer goods and services from the rest of the world. Such partners would thus experience a decline in real income per capita. Traditional trading partners of the US, such as Canada (down 9.5 percent) and Mexico (down 7.2 percent) would be particularly affected. In Japan as well, long-term income per capita would be reduced by almost 6 percent. Additional losers would include developing countries, especially in Africa and central Asia.

The TTIP is not a zero sum game, however, but instead generates real gains in public welfare due to the reduction of trade costs; in principal, therefore, all countries can profit from this reduction. Average per capita income throughout the world would rise by 3.3 percent.

For the EU, a far-reaching free trade agreement would result in a significant increase in employment in the participating economies. According to the calculations, the US and Great Britain will benefit to a particularly large degree, with almost 1.1 million and 400,000 additional jobs, respectively. There would be an above-average impact on employment in the crisis-ridden southern European countries as well. While unemployment in the OECD would decline by an average of 0.45 percentage points, in the four countries in crisis, it would decrease from 0.57 percentage points in Italy to 0.76 percentage points in Portugal.

“A transatlantic free trade agreement would be an important tool for increased growth and employment in Europe,” said Bertelsmann Foundation CEO Aart De Geus, in his presentation of the study. “Especially the southern Europeans, who have been shaken by crises, would benefit from this to an above-average degree. However, social welfare gains that arise for the EU and US should also be an incentive to show a readiness to compromise toward the losers of the agreement in future multilateral negotiations. In this way, the transatlantic free trade agreement could also give fresh impetus to the Doha Development Round, which has come to a stall.”

In their simulation calculations, the analysts looked at two scenarios. Abolition of tariffs alone (Scenario 1) would barely provide for positive effects on growth. On the other hand, if barriers to trade were comprehensively abolished (Scenario 2), the above-calculated effects would occur. These barriers to trade include non-tariff measures such as quality standards, packing and labeling requirements and information on origin, as well as technical and legal requirements for imported products. Non-tariff trade barriers also include subsidies of one’s own exports through tax advantages or financial assistance.

Leave a Reply