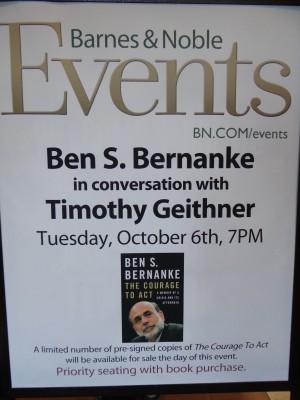

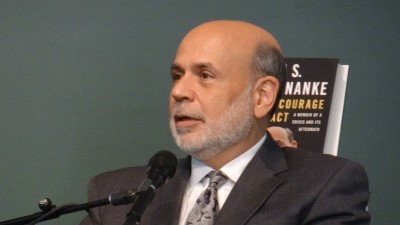

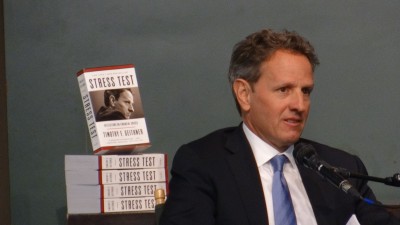

A full house showed up at the Union Square Barnes & Noble in New York City last night with standing room only in the back which I was a part. Set up like a talk-show, Ben Bernanke, former head of the Federal Reserve bank, and Timothy Geithner, former Treasury Secretary during the crash of 2008, were in the middle of the Q&A portion of the event when I arrived.

In an article posted today in the Telegraph on his new autobiography, The Courage to Act, it tells how the former head of the Federal Reserve felt during the crash. “It was a terrible and surreal moment”, when regulators desperately tried to rescue the investment firm Lehman Brothers in 2008.

“We were staring into the abyss,” the former Federal Reserve chairman writes of the intense negotiations, led by Timothy Geithner, then head of the New York Fed, and Henry Paulson, then Treasury secretary. A “blur” is how Mr Bernanke describes the events.

“The journey was nerve-wracking,” he writes. “But most of my colleagues and I were determined not to repeat the blunder the Federal Reserve had committed in the 1930s when it refused to deploy its monetary tools to avoid the sharp deflation that substantially worsened the Great Depression.”

“If I were to try to read, much less answer all the attacks made on me, this shop might as well be closed for any other business” – A quote by Abraham Lincoln that Ben Bernanke kept by his computer screen.

Mr. Bernanke says the main goals of the Fed were to lower interest rates to help the economy, unfreeze credit in the banking system, save the major financial firms and conduct “stress tests” of the biggest banks to reassure investors. No where does he say anything about helping the people who were not responsible for the crash yet were the one’s who took the hit.

This mentality of Too Big To Fail is a co-dependent, dysfunctional, poor economic mentality that is simply untrue. If you screw up then YOU, and no one else, should suffer the consequences. You don’t help the people by saving the banks. You help people by helping people. It’s no different than an abusive husband telling his abused wife she can’t live without him so he beats her and exalts himself. It’s in your face abuse and the people take it.

“Knowing what you know now, would you choose to be famous?” was a question posed to Bernanke of Tim Geithner at the event. “If I could choose between rich and famous I’d choose rich” Bernanke replied.

Geithner then asked Bernanke about the Glass Steagall Act. “The deregulations of the late 90’s early 20o0’s was a mistake and contributed to the crisis. Why Glass Steagall is the poster child for that I don’t quite understand”. Glass Steagall is about keeping investment banking separate from commercial banking and Bernanke said it didn’t matter. “I don’t think that’s the key element of the problem”.

“There’s a lot of things community banks can’t do for the economy”, Bernanke said. They sure don’t have the ability to completely crash the economy like the “big” banks, I thought.

“Dodd Frank has within it the power to break up the banks. The banks are required to submit to the Fed and the FDIC what’s called a Living Will. How would I wind myself down if I came to the edge of financial instability? If the Fed and the FDIC are not convinced the institutions could be safely wound down, they actually have the authority to break them up”.

So why didn’t or don’t they now? I ask.

At the end of the Geithner and Bernanke verbal fiat, most of the crowd didn’t heed the opportunity to challenge either Geithner or Bernanke on the greatest financial depression since the one of 1929 except for a couple of demonstrators advocating for the NEED Act as put together by former Congressman Dennis Kucinich. Ignored by politicians and corporate media alike, the NEED Act would:

- Pay every American a Citizen’s Dividend that could easily be $10,000 for every man woman and child in the country, thus giving small businesses what they need: customers with debt-free money to purchase their goods and services.

- Pay off the national debt, as it comes due, without deficit spending.

- Create 7–10 million new jobs repairing the nation’s crumbling infrastructure.

- Provide debt-free funds to beleaguered state governments. Indiana’s would initially be about $1.5 billion per year for example.

- Provide interest-free, loans to local governments for schools, libraries etc., replacing the present system of financing through interest bearing bonds.

Understanding why the National Emergency Employment Defense Act (the NEED Act), H.R. 2990 was ignored and what needs to be done to put it back before Congress again, only this time with strong citizen support, involves a discussion of who creates and benefits from our money.

The Federal Reserve System celebrated its 100th anniversary on Christmas Eve 2013. Contrary to what most Americans think, it is not a part of the U.S. government. Rather it is network of privately owned banks, wholly controlled by a handful of Wall Street megabanks: Chase, CitiBank, Bank America and Goldman Sachs.

In 1913, the Federal Reserve Act ceded the power to create the nation’s money supply to the private Federal Reserve System and its private member banks. Anyone doubting their absolute power should hearken to Assistant Senate Majority Leader Dick Durbin of Illinois statement following the financial crash of 2008 and the inability to regulate the banks: “frankly they (the banks) own the place (Capitol Hill).”

At the end of the show, protester Harrison Schultz held up a sign reading “FEELING FUCKED??? IT’S THE FED’S FAULT!” as he yelled out trying to engaged the departing crowd, “Why are private Wall Street insiders making our government’s money? Why are there interest rates in the first place? WHO are those interest rates being paid to?”

Leave a Reply