From VOA:

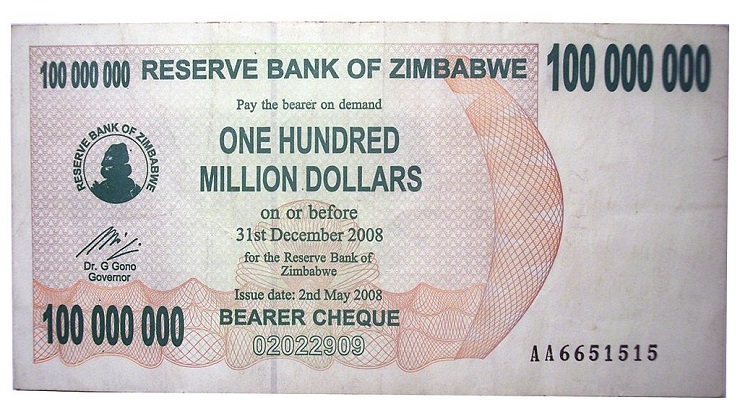

Zimbabwe’s central bank says it will soon introduce a new currency, which is expected to be at par with the bond notes and coins, amid serious cash shortages in the country.

Governor of the Reserve Bank of Zimbabwe (RBZ), John Mangudya, told reporters in Harare today that the introduction of the new currency is designed to ease the current cash crunch.

Mangudya, who chairs the Zimbabwe’s Monetary Policy Committee, said the RBZ would introduce two and five dollar notes. He could not be drawn to provide details of the new currency.

He said the move would also result in an upward review of daily cash withdrawals and also curb high premiums on cash.

“The Committee noted that the level of physical cash in the economy is inadequate to meet transactional demand, considering that the current proportion of cash to broad money supply of 4% is low compared to regional and international levels of 10-15%. This low ratio has resulted in an undesirable cash premium which the Committee would like to see eliminated.

“In this regard, the Committee noted with satisfaction the fact that the domestic economy in 2019 achieved new heights in terms of the utilization of electronic systems for market transactions. However, the Committee felt that there was a need to boost the domestic availability of cash for transactional purposes through a gradual increase in cash supply over the next six months.”

He noted that the committee noted the need to review upwards cash withdrawal limits to ease the burden on the transacting public.

“This additional cash injection will be carried out through the non-inflationary exchange of RTGS money for physical cash.”

Mangudya said the Committee is committed to see efficient, stable and competitive financial markets with minimal obstacles and regulations for sustainable economic development.

“The Committee remains convinced that if strict fiscal and monetary discipline are maintained, it will be possible to achieve low inflation and stability within the shortest possible time.”

Reacting to this move, some independent economists warned that the introduction of a new currency is likely to result in the shrinking of the local economy expected to contract by 6.5% this year.

But the Monetary Policy Committee noted that key basic economic fundamentals remain sound, and in place for the country to meet its stabilization and development objectives.

“… Thus, notwithstanding the projected contraction in Gross Domestic Product (GDP) growth by around 6.5% in 2019 on account of the twin climatic shocks, the devastating drought and cyclone Idai, the foreign exchange generation capacity of the economy is still sufficient to support a stable exchange rate.

“This is also reflected in the projected narrowing of the current account deficit to 1.5% by end of year, and if sustained, this is a positive trend for the Balance of Payments position.”

According to Mangudya, the Committee is of the view that the country’s potential growth rate is still strong and needs to be buttressed by appropriate structural policies to ensure sustainable growth.

On inflation, Mangudya said Zimbabwe is concerned the continued inflationary pressures in the economy.

“However, these are projected to recede in the outlook period as attested by the recent decline in monthly inflation from 39.26% in June 2019 to 18.07% in August and further to 17.72% in September 2019. A monthly rate of 10-12% is projected for the year end. Current inflation trends are largely driven by inflation expectations and temporal shocks from speculative pricing as well as the recent increase in reserve money.”

To curb some of the inflationary trends, Mangudya said the Committee noted that there is need to limit the exchange rate pass through effect to inflation by stabilizing the exchange rate and boosting confidence in the local currency.

Leave a Reply